How does your business calculate the right bid for a job? Do you sort out the job cost and then increase it by a third? Do you use the “10 and 10” method, adding a 10 percent overhead and 10 percent profit? Are you able to differentiate between margin and markup? When is the last time you double checked those figures?

Financial expert George Hedley estimates that at least three-quarters of installation contractors don’t know how to estimate the markup they’ll need to cover job costs plus overhead and still turn their projected profit margins. Larger companies may find that their markup needs to be higher to cover increased overhead costs or to ensure that current or future investors are seeing healthy profit margins.

Understanding the difference between margin and markup is critical for contractors and business owners. We created this helpful Margin vs. Markup guide so you know your numbers are right.

Common terms defined:

Job costs include everything you’ll need to complete the work. This includes labor, materials, leased equipment costs, projected capital costs (if borrowing money for the job), bonding premiums, permits, gas, and other materials and supplies.

Overhead is all the bills and expenses not included in the above job costs that you will need to pay in order to operate your business. While this sometimes varies, it includes things like rent for your office, office-based support staff, some types of insurance, tools, equipment, bookkeeping, accounting, legal costs, owner’s salaries, outstanding debt payments and whatever else it might take to keep the lights on if you don’t have active jobs.

Net profit is the remaining amount after job costs and overhead are subtracted from the price. With net profit you can make capital investments in the company (new office, new equipment or machinery) and take distributions from the business in addition to your salary. A healthy business should be able count a net profit of at least 8%, experts say.

What is the difference between margin and markup?

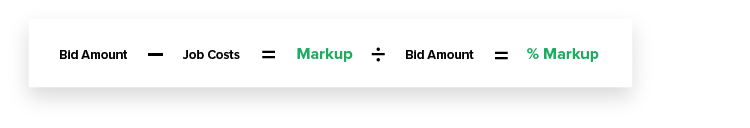

Markup is the sales price, minus the job costs. Margin is the sales price minus the job costs and minus overhead allocation.

Here’s an example:

Let’s say you’re bidding on a job that will cost your company $200,000 to complete with materials, labor, and equipment, and you plan to bid $250,000. Your total sales forecast for the year is $1 million and your annual expected overhead costs at that level is $80,000. That’s an 8 percent cost of overhead. In other words, you need to tack on more than 8 percent to the cost of the job just to break even.

Many companies don’t take such a close look. Your business may be spending too much on overhead, or in times of growth, may not set aside enough to cover the cost of rent or to pay your own salary.

Your markup would be calculated as follows:

Using the overhead, you can also calculate the margin:

At the end of the day, having too thin of a margin can leave your company vulnerable if something goes wrong on the job, like a weather delay or another trade’s issue. A good bid is never about just tacking on some standard percentage to your job costs. It’s about being precise about your business’s financial needs.

If you found this blog helpful and informative, you may also enjoy our newsletter. Click here to subscribe and get more tools and resources sent directly to your inbox every two weeks.

Recommended Reading

https://mobilizationfunding.com/2019/05/22/3-bidding-mistakes-killing-profit-margin/